Tariff Wars, Round Two: What Happens Now?

You can call it whatever you want but this has been a declaration of war by the United States on everyone. Well, almost everyone, Russia doesn't seem to be bothered.

Again? Back in November, shortly after Donald Trump won the presidency for a second time, I wrote an article explaining tariffs. It was straight forward and meant as a basic introduction to the topic and the impact the first round of tariffs had and what we might expect from Trump and his love of tariffs in his second term.

A quick summary:

Tariffs are taxes imposed by governments on imported goods

The primary purpose (historically) is to increase the cost of imported items making them less competitive compared to similar domestic products

Secondary purposes are protection of domestic industries (often highly selective and given as political favors), job creation (only about 1,800 jobs were created at a cost of $815,000 per job) and as trade agreement negotiating points

Results: Trump's 2018 tariffs on China led to higher prices, disrupted supply chains, increased inflation, and produced lower-than-expected job creation at a higher-than-expected cost. No new economically viable jobs were created. No increase in domestic manufacturing. No improved trade agreements. Loss of significant agriculture sales (see soy beans: prior to 2018 tariffs the China accounted for 66% of the US export of soy beans. After tariffs, soy beans shipments to China dropped 75%. We have never recovered this business since China replaced the majority of these sales with soy beans from Brazil). No significant increase in revenue for the government. Total increase in revenue generated from tariffs is less than 2% of the GDP.

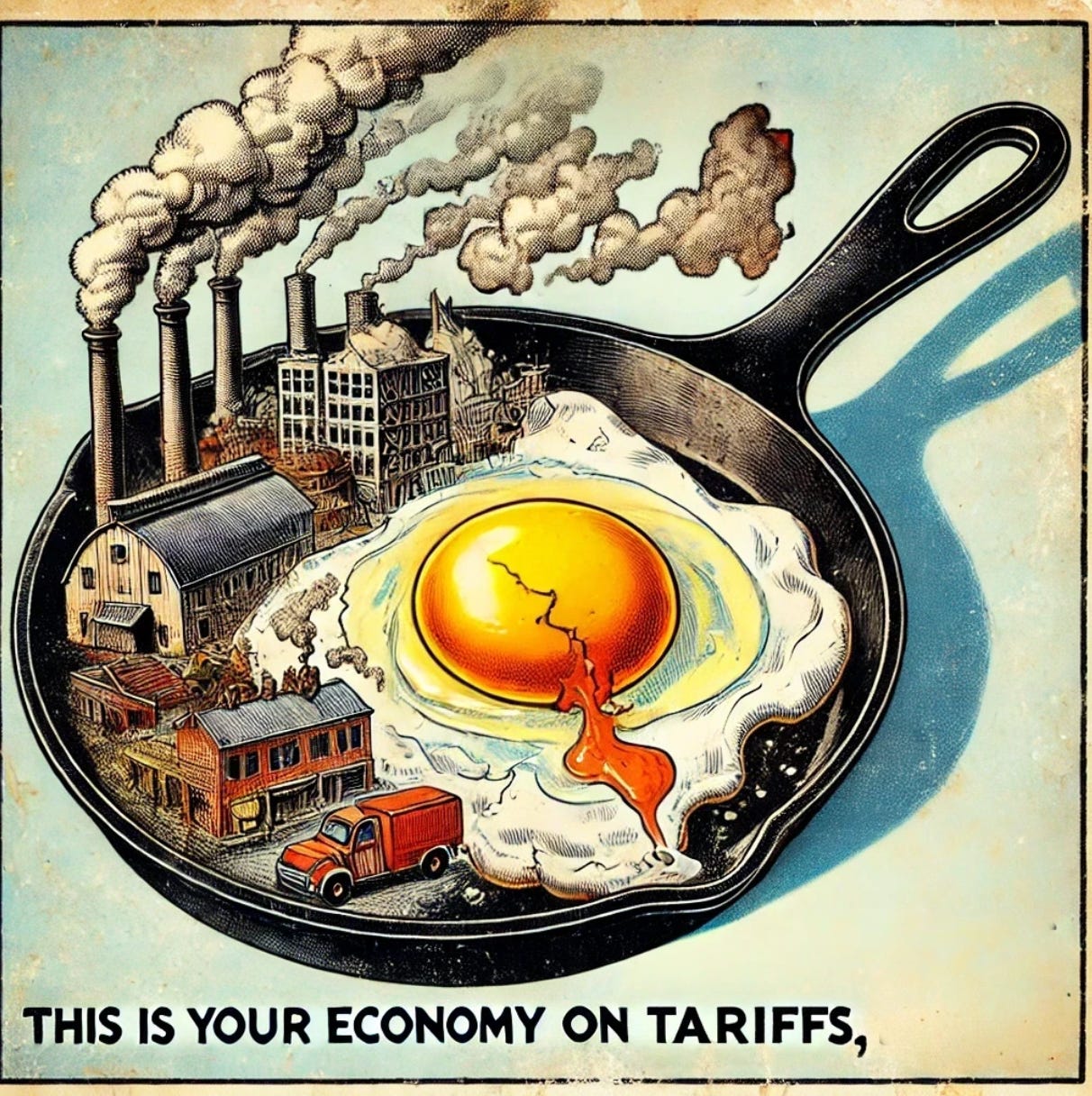

So why are we back in the same place. The answer here must be if a few tariffs didn’t work then, a whole mass of tariffs (I’d hesitate to call it a large scale tariff plan) against multiple countries, ex-friends and foes alike, has got to work, right?

Trumps’s Character/Approach: I’m not a psychologist nor do I play one on TV but it seems that Trump’s interactions are all transactional. It’s what can you do for me? Doesn’t care about past history. Doesn’t care about human rights, or human rights violations. Doesn’t care about decades of partnerships or agreements or the advancements we’ve made by working together. Every deal is independent.

Solo.

But the world today is interconnected.

It’s like a toxic relationship where your partner immediately tries to separate you from your friends and family. He needs us separate because separate creates dependence. It grants more control.

And Tariffs separate us from the rest of the world.

Since Trump has started his second term, we’ve withdrawn from the World Health Organization (WHO), the Paris Agreement (cancelling an agreement we’d made with majority of the countries on the planet), United Nations Agencies (including UN Human Rights Council, UN Educational, and Scientific, and Cultural Organization (UNESCO), and the UN Relief and Works Agency for Palestinian Refugees (UNRWA), and others), International Climate Initiatives (an international organization intended to support countries severely impacted by climate damage), and US Agency for International Aid (USAID). It’s a two-prong approach of attacking and withdrawing.

It’s do what I want or suffer the consequences.

This approach has alienated us and separated us from all countries with the exception of Russia. But if it’s all transactional? Alliances don’t matter. The message has been made clear. The U.S. cannot be trusted to abide by our agreements. It’s just about the deal. It’s about a single transaction.

Even deals negotiated by the Trump team aren’t honored. These current tariffs contradict the U.S.-Mexico-Canada trade agreement negotiated by Trump during his first term. But that was yesterday. That was many transactions ago. It no longer counts regardless of what was signed on that piece of paper.

It’s tariffs as the stick without any carrots in sight.

The Law of Unintended Consequences

There’s no sure-thing anymore. And our actions do have consequences. And since we’ve built our dominate position in the world through cooperation and innovation, tariffs (attacks) and withdrawals (removing ourselves from the world political stage) impacts the rest of the world as much or more than us. Countries respond. Companies respond. People respond.

We don’t know what will happen in the long run. We do know what has happened as a result of the last round of tariffs:

China: the target of the 2018 tariffs didn’t just roll over, belly up, and beg forgiveness from the US. They went to work. They created domestic initiatives. They strengthened alliances. They reached out to countries traditionally aligned with the US.

Here are just of few of the responses from China and the rest of the world:

Diversifying Export Markets: To reduce reliance on the U.S. market, China has expanded its trade relationships with other regions. Initiatives like the Belt and Road Initiative (BRI) have strengthened economic ties with countries across Asia, Africa, and Europe, opening new markets for Chinese goods and services. China actively participates in numerous trade agreements and organizations to enhance its global trade relations. As of March 2025, China has signed and implemented 21 Free Trade Agreements (FTAs) with various countries and regions. Included in these agreements is the RCEP trade group - which consists of 15 countries throughout Asia - and is the world’s largest trade group. China isn’t reliant upon the US market for it’s exported goods.

Enhancing Domestic Innovation: China has invested heavily in technological advancement and innovation to reduce dependency on foreign technology. The "Made in China 2025" plan aims to transform China into a leader in high-tech industries, including robotics, aerospace, and renewable energy. China is now the world’s leader in electric cars and electric car technology. China is the world’s leader in green energy technology, including the manufacturing of solar panels and the development of thorium based nuclear energy (a cleaner, more sustainable, method of nuclear fusion). As a part of the focus of China 2025 they’ve set goals to become the first country to be 100% vertically integrated on the AI chip production process.

Strengthening Regional Trade Agreements: China has actively participated in regional trade agreements to secure stable trade partnerships. Its involvement in the Regional Comprehensive Economic Partnership (RCEP) has solidified economic ties with neighboring countries, creating the world's largest trading bloc and providing a buffer against U.S. tariffs.

Investing in Global Infrastructure: Through the BRIC, China has invested in infrastructure projects worldwide, enhancing trade routes and increasing its influence in global trade logistics. This includes developing ports, railways, and highways that facilitate smoother trade flows with partner countries. These investments in infrastructure for developing countries came at the same time the U.S. has withdrawn support for these nations via the USAID cancellations.

Implementing Counter-Tariffs: In response to U.S. tariffs, China has imposed its own tariffs on U.S. goods, aiming to pressure the U.S. to reconsider its trade policies. These countermeasures target key U.S. exports - especially agriculture which the U.S. was a world leader - creating leverage in trade negotiations. These counter tariffs actually killed some of the U.S. markets - soy beans as an example - which caused the U.S. to create huge subsidies for agricultural corporations to offset this loss. China has not used any major tariffs on their other trade partners.

Promoting the Yuan in International Trade: China has encouraged the use of its currency, the yuan, in international transactions to reduce vulnerability to U.S. financial policies. This strategy includes establishing currency swap agreements with other countries and promoting the yuan as a global reserve currency. Countries are beginning the switch especially in the trade groups China has formed or joined.

Supporting Domestic Industries: The Chinese government has provided subsidies and tax incentives to domestic industries affected by U.S. tariffs, helping them remain competitive and sustain growth despite external pressures. They also allowed their currency to devalue during 2018 tariffs. This offset the overall impact of the tariffs and helped their manufacturing companies to remain competitive despite heavy tariffs.

Technological Advancements (think AI chip production): AI chip manufacturing is a global process. There are multiple steps involved.

Step 1: Raw materials. China supplies about 79% of the world’s raw materials including the rare earth metals required.

Step 2: Wafer production. Raw materials are turned into wafers that are used in the producing the AI chips. Japan supplies about 56% of the wafers used followed by Taiwan at 16%. The U.S. has no significant wafer capabilities.

Step 3: Chip design. The U.S. is the world’s lead chip designer but does use technologies from other countries in the process.

Step 4 Chip manufacturing. Taiwan supplies about 50% of the world’s chip manufacturing but China and the US have significant manufacturing capabilities. Step 5 Testing, assembly, and packaging (TAP). This is done in many locations around the world. In short, this is a global process that is hurt by tariffs. China has committed to being the first country to vertically integrate the entire process. With the current technology which requires certain raw materials that China dominates, they may be the only country capable of this. They expect to complete this program by 2030.

Manufacturing Centers: Manufacturing shifted from China to Vietnam, Malaysia, and Mexico among other developing nations. Mexico is now the largest exporter to the U.S. Many of these manufacturing companies are Chinese that relocated during the first Trump trade war. Estimates are that over 80% of Chinese companies have made alternative manufacturing or shipping plans to help fight any new tariffs. Manufacturing has not come back to the U.S.

The US Dollar: China has been systematically reducing its holdings of U.S. Treasury securities over the past decade. This program ramped up after the 2018 tariffs. In November 2013, China held approximately $1.316 trillion in U.S. Treasuries. By December 2024, this figure had declined to $759 billion, marking a reduction of about $557 billion, or approximately 42%. The largest current holder of U.S. Treasury Securities is Japan. As the US Dollar becomes less dominate in world trade it becomes less desirable. These securities are a major source of income for the U.S. and help pay our debt. If they are not as desirable and countries don’t buy as many the U.S. will have to pay higher interest rates. Thus making it harder and more costly to pay our debts. Thus increasing inflation and costs.

What to Expect This Time: The Likely Immediate Effects

China has prepared themselves. Their path has been set in motion. A policy of continued tariffs will not impact their economy or manufacturing base as intended. We’ve seen this from the first round. This round of tariffs has been expanded to more and more countries and hits more and more products. Expect greater turmoil.

Likely events:

Consumer goods will get more expensive: Companies pass the costs to consumers.

Tariffs act like an inflationary tax: If inflation is already a concern, tariffs will add fuel to the fire.

China, Canada, Mexico, and Europe will retaliate: Expect counter-tariffs, tougher customs policies, and strategic economic responses. And if you think of this as a brand building exercise we have negatively impacted our “Made in the USA” brand. Expect to face consumer backlash on U.S. products in international markets.

Supply chains will adapt—just not in America’s favor: More manufacturing will shift to Mexico and Southeast Asia, not back to the U.S. Countries will also become more creative in their processes. Often disruption of supply chains creates new technologies and approaches to product development. We saw this in the AI markets. Emerging tech companies in China - without easy access to AI chips - are developing new technologies, in companies like DeepSeek, and making huge leaps forward in AI.

Loss of faith in the US honoring our agreements: Ignoring treaty obligations could deter other countries from entering into agreements with the U.S. Our current tariff plan violates the trade treaty between Canada, Mexico, and the U.S. Also the withdrawal of funds we had previously committed to hurt our reputation and standing in the world.

Stock market reaction: Last time, markets took a hit—investors will brace for impact again. Have you taken a look at your portfolio lately?

Buckle Up, Again

Higher costs are coming. Inflation is coming. Recession is coming. You and I, and to a lesser extent businesses, will pay the increased costs. These tariffs are likely to change the landscape of world trade but not in our favor. History has shown that these policies are highly ineffective (the Wall Street Journal called it: The Dumbest trade War in History).

It’s not the 1890’s anymore. We thrive in an interconnected world.

It’ll take decades to restore trust in our nation.

Think About It…

Is the United States of America a brand? Is it recognizable throughout the world? Are we trending positive? Or negative? Is this how you would build a brand? Or re-invigorate a brand?

If you want to leave an opinion you can leave a review for our country here.

Do It…

Read it: Not saying it’s true but it makes for good reading. And we should all look at everything to understand and decide for ourselves. Michael Sellers is a reliable thoughtful source. Check him out. - A Deeper Look at Claims by KGB Officer that Trump was Recruited by Soviet Intelligence in the 1980s.

On Tyranny by Timothy Snyder - You want to know what you can do to make a difference. Start by reading this book.

Watch it: It’s just fun. I mean, Cher and the Jackson 5. Smile. It’s good for you.

Quote it: Ok. I don’t believe that perfection is ever the goal but the sentiment is valid. Perfection only occurs in a single moment and is then gone. Poof. It’s no different than a failure. Both are transitory. Enjoy. And start again with a beginner’s mindset.

One can't understand everything at once, we can't begin with perfection all at once! In order to reach perfection one must begin by being ignorant of a great deal. And if we understand things too quickly, perhaps we shan't understand them thoroughly.

― Fyodor Dostoyevsky, The Idiot.

If you want to check out some great reading list and see which books have influenced, surprised, educated, and entertained me, check out my book shop here. The lists grow monthly and I don’t recommend any books I haven’t personally read. Yes, I get a little commission but if you’re going to buy a book anyway, please buy it here. It may be a buck or two more than Amazon but a part of every purchase goes to support local book stores. Independent book stores are a center for independent thought. Help keep them alive. You can also check out my book recommendation engine. It’s fun.